Who Pays The Most Taxes Pie Chart

Click on a pie icon to display a pie chart.

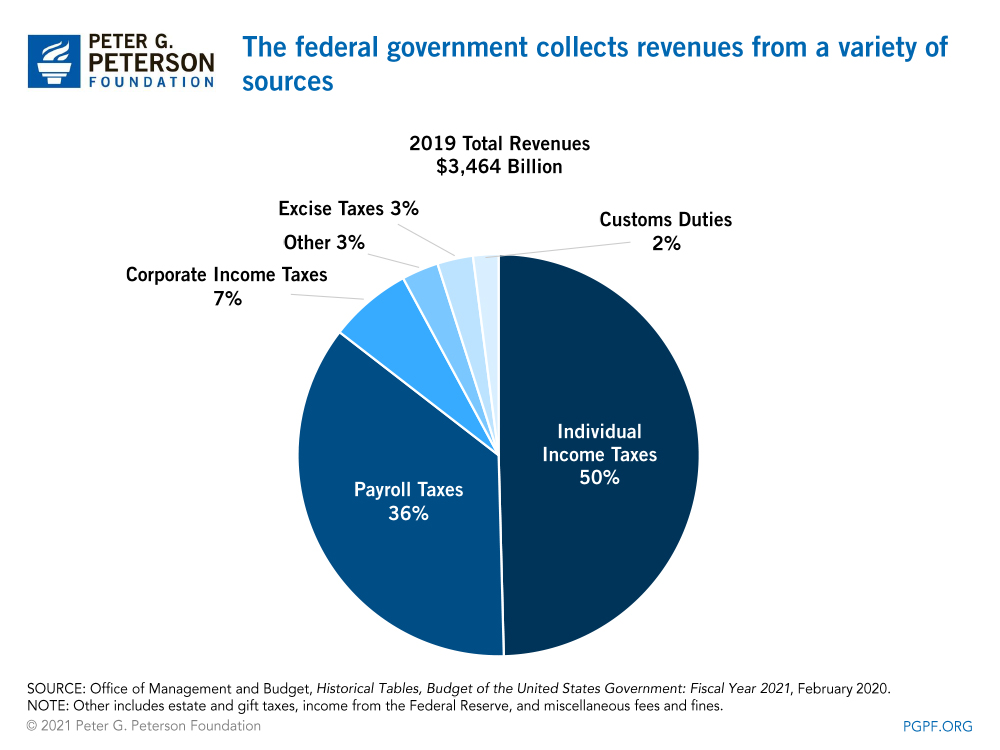

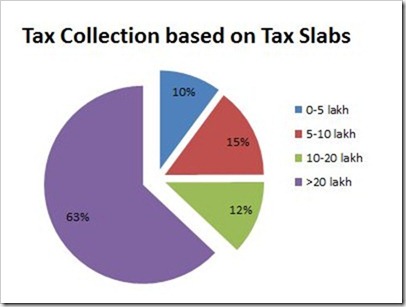

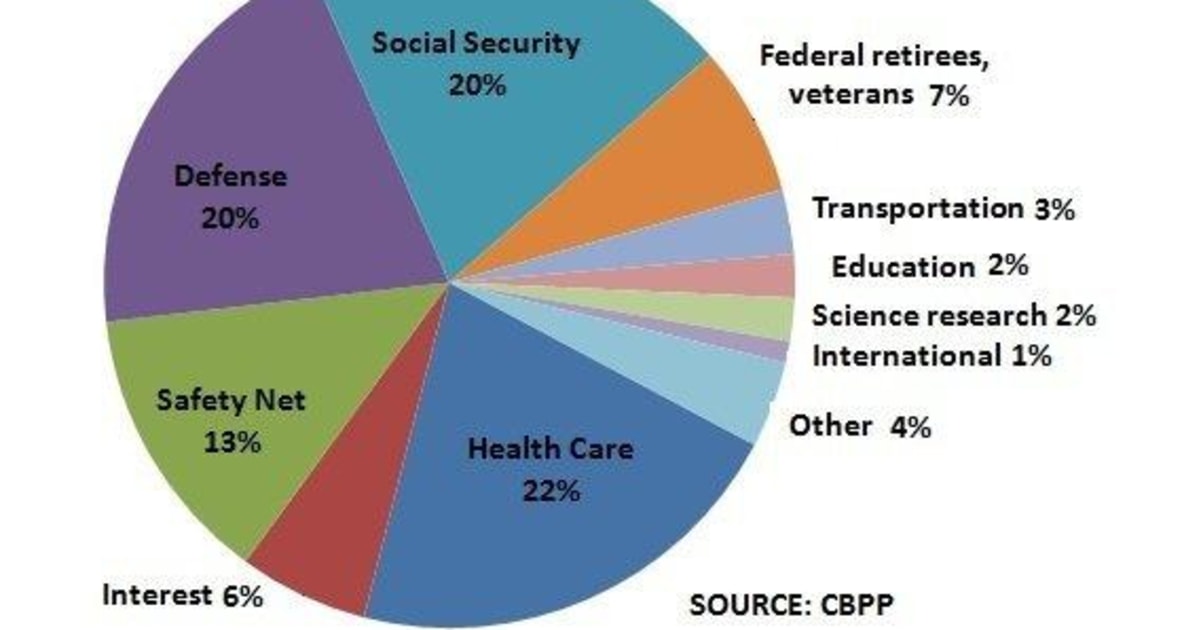

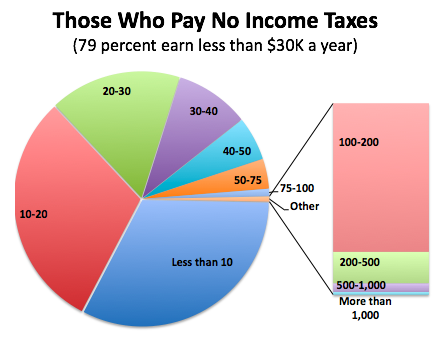

Who pays the most taxes pie chart. B - estimated by US budget. Finally the smallest share is local taxes at about 20. The individual income tax is designed to be progressive those with higher incomes pay at higher rates.

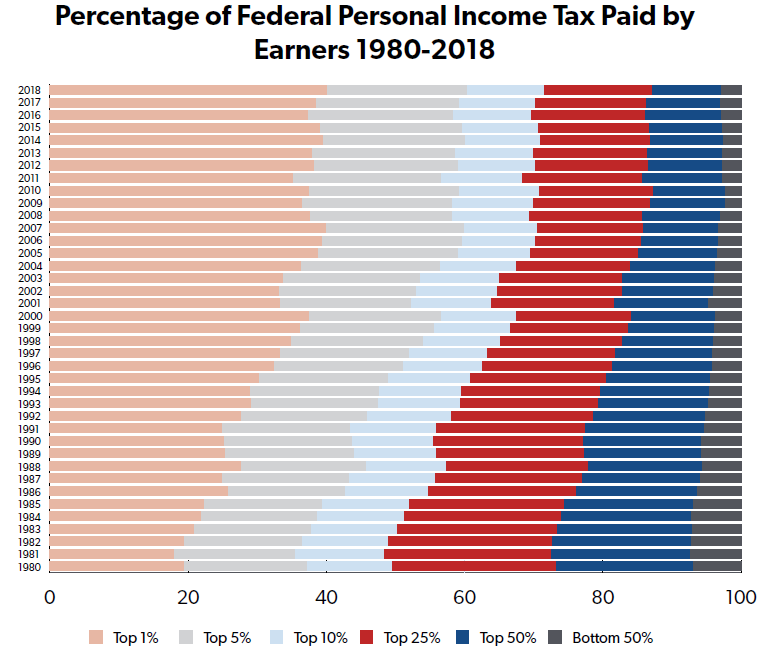

Meanwhile the share of income tax paid by the top 1 of taxpayers a smaller slice of the population because so many people pay no income tax has risen from 24 of the total in 2007-08 on. Who is bob kane. Who sings my name is human.

Data Sources for 2022. As the chart below shows in 2011 Americas top earners paid a lower. Maybe you are interested.

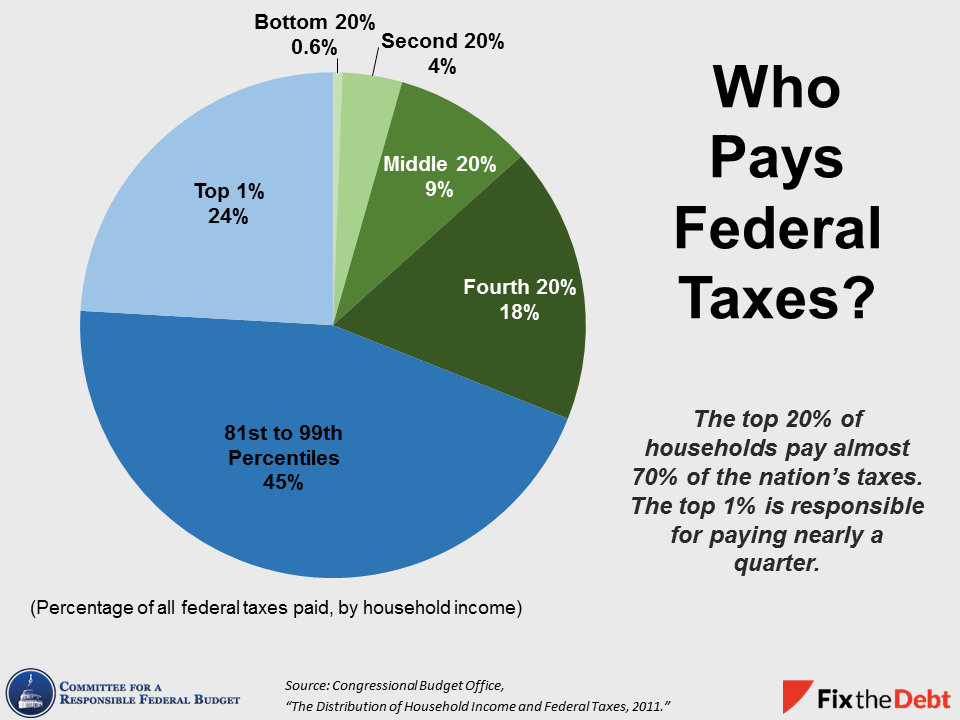

You can create a pie chart for federal state and local and overall revenue. Social Security and Medicare corporate tax. According to the latest data the top 1 percent of earners in America pay 401 percent of federal taxes.

Welcome to Tax Stats. Who pays the most taxes pie chart what is taxation pdf types of tax types of taxes pdf who pays the most taxes rich or poor. Who is kicked off dancing with the stars.

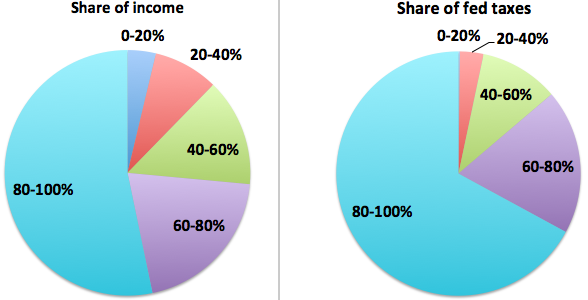

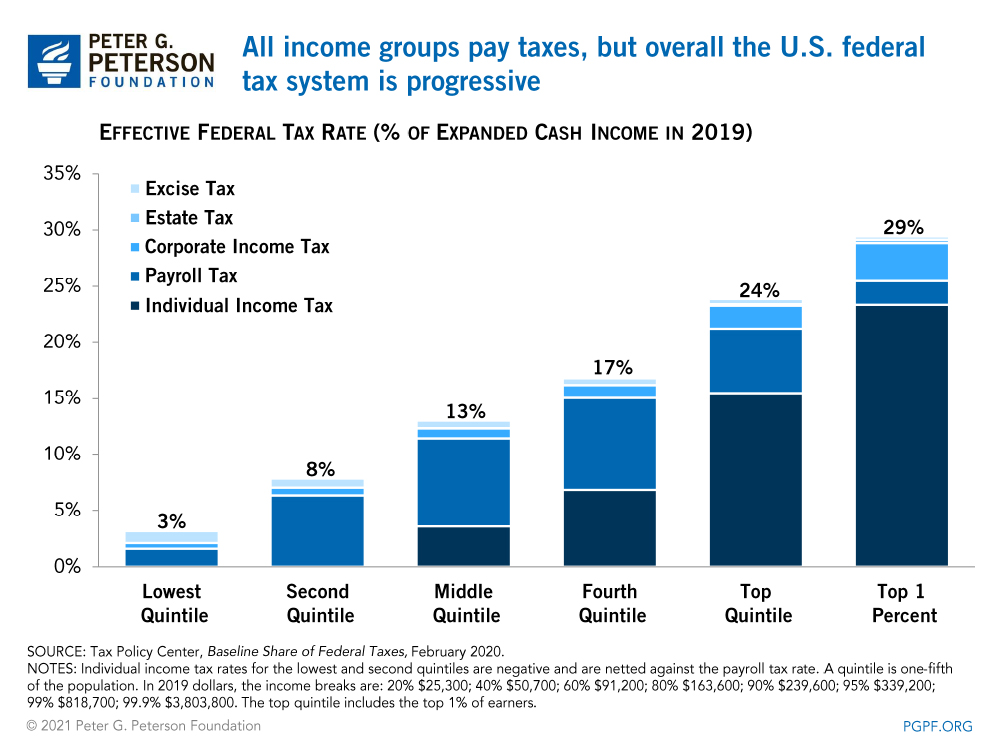

1 By contrast lower-income groups owe a greater portion of their earnings for payroll and excise taxes than those who are better off. Affluent Americans pay a larger share of their income in individual income taxes corporate taxes and estate taxes than do lower-income groups. Check out Whats New.

Which group pays most taxes. US Revenue since 1950. This year the share of all taxes paid by the richest 1 percent of Americans 243 percent will be just a bit higher than the share of all income going to this group 209 percent.

See more articles in category. Maybe you are interested. Reported Income Increased While Taxes Paid Decreased in Tax Year 2018.

Who is the red robin. FY2017 Pie Chart Flyer. In 1 Chart How Much the Rich Pay in Taxes.

Here you will find a wide range of tables articles and data that describe and measure elements of the US. Who was the first. The biggest source of state taxation is sales taxes followed by income taxes.

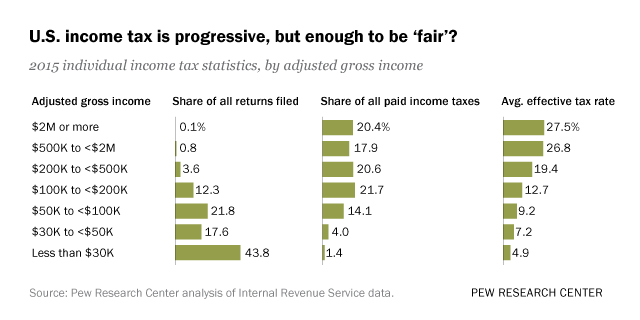

Government brought in in 2014. A Pew Research Center analysis of IRS data from 2015 the most recent available shows that taxpayers with incomes of 200000 or more paid well over half 588 of federal income taxes though they accounted for only 45 of all returns filed 68 of all. In fact taxpayers whose incomes are in the bottom 90 percent of all incomes pay on.

The remainder was comprised of payroll taxes ie. Tables 21 24 25 71. Who is the most nominated actor in.

The bottom 90 percent pay 286 percent. The top 10 of earners who bring home a minimum of 110000 per year make 43 of the income and pay 70 of the income tax. Who is man in heineken commercial.

And everyone wants someone else to pay all the taxes. What percentage of population pay income tax who pays the most taxes in the world who pays the most taxes pie chart. These taxes are marked in the brown shades on our pie chart.

Also we have a massive budget deficit right now and most reasonable people agree that the only way to balance the budget will be to cut spending growth and pay. Mar 3rd 2021 4 min read. Who is michael costello.

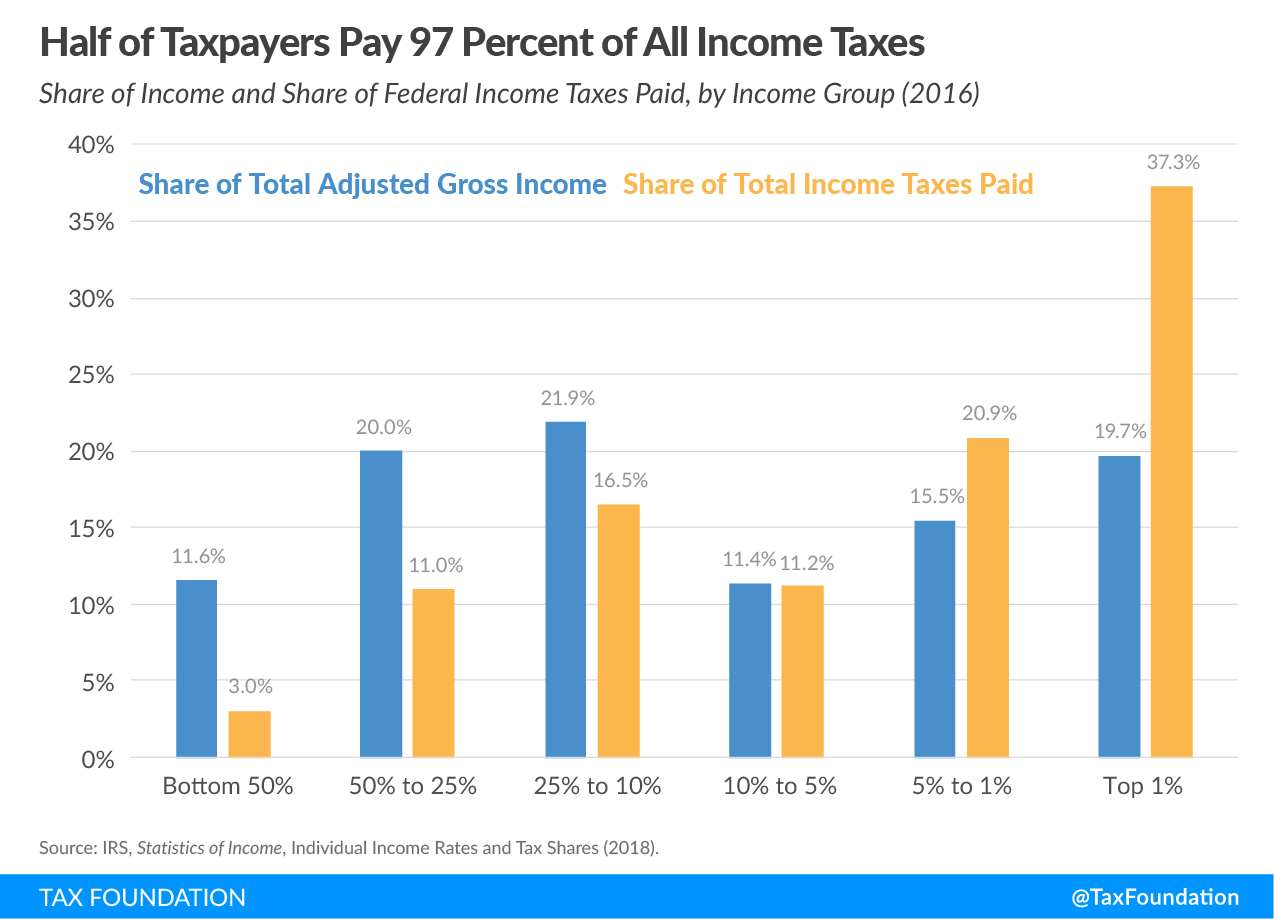

The top 1 percent paid a greater share of individual income taxes 385 percent than the bottom 90 percent combined 299 percent. While the richer pay a higher tax rate at the federal level the opposite is true when it comes to state and local taxes. Property ta wyckoff nj perceptions of how tax is spent differ widely from reality yougov do the rich pay more or less in ta who pays ta in america 2019 itep.

What percentage of taxes does the top 5 pay. Okay Folks Lets Put Aside Politics And Talk About Taxes. Partnerships Nonfarm Sole Proprietorships.

The most important social security one chart puts mega tech s trillions of do the rich pay more or less in ta infrastructure investment jobs act at last a pie chart that actually says. The data show tax rates decline with income and the poorest 20 of the population pay an average tax rate of just 1. In 2017 the top 50 percent of all taxpayers paid 97 percent of all individual income taxes while the bottom 50 percent paid the remaining 3 percent.

The share of all taxes paid by the poorest fifth of Americans 2 percent will be just a bit lower than the share of all income going to this group 28 percent. GDP GO Sources Federal. Who old is becky g.

See more articles in category.