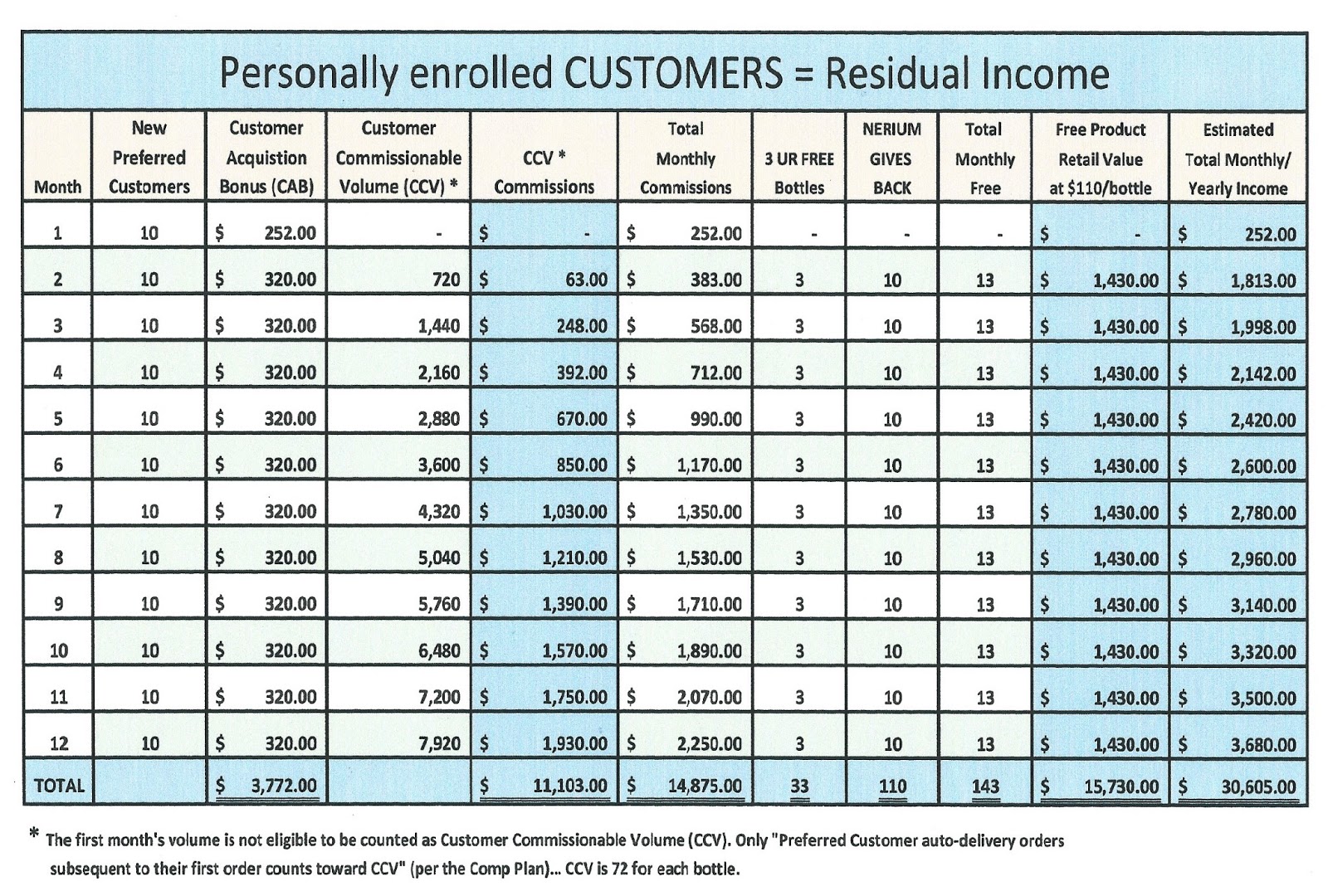

Va Residual Income Chart

Additionally when the computed DTI is greater than 41 VA requires the residual income requirement to be increased by 20.

Va residual income chart. Lenders require that borrowers with DTI of more than 41 have 20 higher residual income. After these payments you have your residual income which is typically used for personal expenses such as. Va residual income chart 2020 pdf - ROCKYMOUNTAINRESISTER.

Item 45 Debt-to-Income Ratio VAs debt-to-income ratio is a ratio of total monthly debt payments housing expense installment debts and other debt to gross monthly income. Residual income on VA loans test needs to be met by borrowers. VA debt to income ratio is important but residual income is more 866-719-1424.

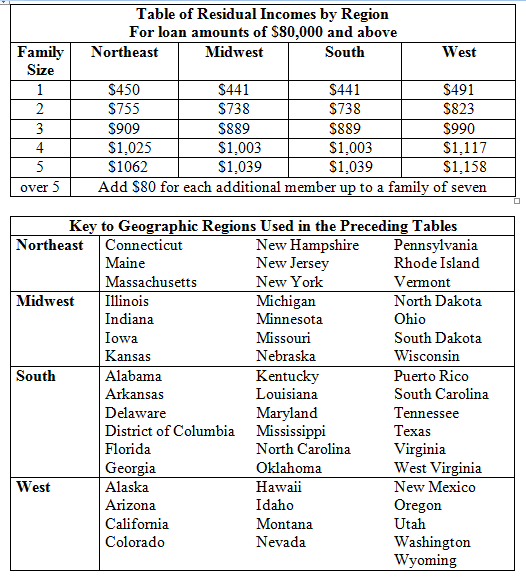

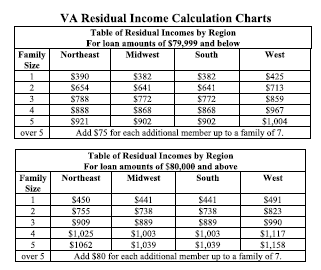

With the calculation famc created a residual income worksheet. In our case the 1003 minimum would increase to 1204. VA Residual Income Chart for Loan Amounts Above 80000.

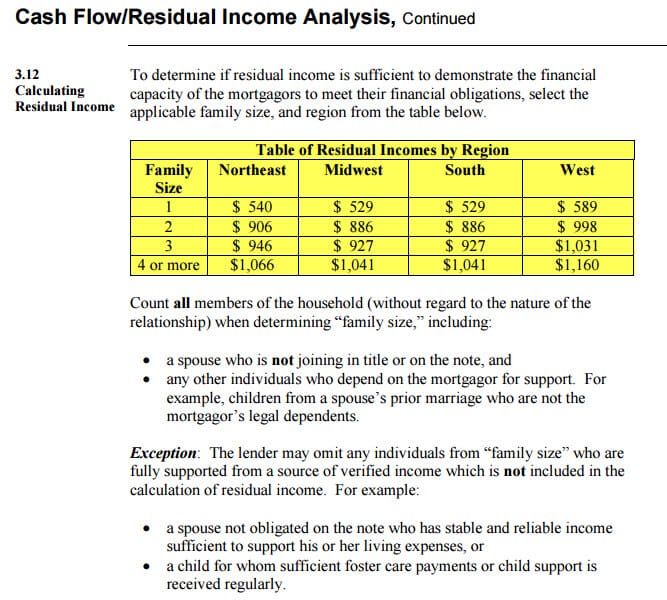

Amount Required Per Residual Chart b. Here is the Residual Income Chart. Actual 1 minus 2 3 4 5 7.

This video and its contents are not intended for residents or home owners in the states of MA NY or WAThis video is a follow up video from one we did earl. Using the following tables the required residual income for a family of four in the Midwest is 1003 when purchasing a home valued greater than 80000. Debt Income Debt-to-Income Ratio.

A VA residual income calculator can help you understand how the chart applies. These monthly obligations would include your car payment mortgage student loans and credit card bills. VA Residual Income Chart Shows How Much You Need to be VA Eligible Another major factor is making sure from the get go that a military borrower would be able to afford the mortgage over time.

However the Department of Veterans Affairs wants to make certain that you have enough money left over to take care of your day-to-day expenses. What is va residual income requirement. Factors that are included in the VA Residual Income calculation are but not limited to.

Thus the residual income limits in the chart above are for borrowers whose DTI is not above 41. VA Residual Income Charts Guidelines. The minimum residual income depends on the number of family members in a household.

The VAs minimum residual income is considered a guide instead its most often considered in conjunction with other credit factors. An example based on a 250000 loan in Austin Texas South region for a family of four. Items 15 16 17 18 20 40 Debt.

1 How to Underwrite a VA-Guaranteed Loan 4-2 2 Income 4-6 3 Income Taxes and Other Deductions from Income 4-25 4 Assets 4-27 5 Debts and Obligations 4-29 6 Required Search for and Treatment of Debts Owed to the Federal Government 4-34 7 Credit History 4-40 8 Documentation for Automated Underwriting Cases 4-46 9 How to Complete VA Form 26-6393. VA residual income chart provides minimum residual income for each region and state. To the nearest two digits.

Debt-to-Income Ratio VA guideline 41 2 3 divided by 1 Residual income exceeds the guideline 20 percent. Because this loan applicant has 2204 in residual income he or she has passed the residual income test. Understanding the debt-to-income ratio and residual.

Residual Income is the money left over after you have paid each of your monthly debt obligations. This heavy take on affordability takes a multi-faceted holsitic approach which this article. Residual income equals gross income less maintenance and utility expense and other monthly shelter expenses.

For example if the DTI ratio for a family of three in Oklahoma South is 44 higher than 41 the residual income requirement will be 20 higher than the standard requirement. A family of four in Texas would need 1003 in residual income based on the below charts. A VA loan borrower in Ohio then with.

For applicants whose residual income exceeds the VAs minimum residual income guidelines by 20 or more debttoincome ratios can be a nonfactor. If your debt-to-income ratio is 43 you now must have a residual income of 1203 to be approved for a VA loan. Items 31 38 Income.

Income verification for VA loans also uses something called residual income. For the tables below one is for VA loans under 80000 and the other is for 80000 and above.